Summary: Not all rent reporting services are created equal. We review ten rent reporting options and how to choose which one will be best for you.

Many people do not realize that their rental or lease payments are not usually reported to the three major credit agencies.

This is unfortunate because the reporting of your monthly payments to the credit bureaus could have the single most positive influence on a credit score.

But you can fix this problem...

Not only can you pay a Rent Reporting service to report your monthly payments, but you can also have them report 24 months of previous rental payments.

When choosing a rent reporting service, the two most important factors to consider are the number of credit bureaus that they report to and their initial cost including the reporting of your 24 months of previous rental payments.

Increase Your Credit by 100+ Points

In a recent study at Credit Knocks, we found that *48% of clients who used a credit repair company got a credit score increase of 100+ points.

Consultation is quick, easy, and free.

Rent Reporting 101

When you apply for a loan, lenders will contact one of the three major credit bureaus; Experian, TransUnion, or Equifax to get your FICO or Vantage credit score.

Your credit score represents how much of a credit risk you would be to the potential lender and is calculated by the credit history in your file.

Lenders and credit furnishers do not always report to all three credit bureaus, and rent reporting services are no different.

Because of this, the reported information in your credit file is different at each of the three bureaus and result in a totally different credit score being calculated for each.

You will be offered an interest rate based on the credit score pulled from ONLY one of the credit bureaus with higher credit scores being given the best interest rates and lower credit scores left with the worst interest rates.

The difference in the amount paid in interest for a real estate mortgage between someone with a low credit score and a high credit score can be tens of thousands of dollars.

Also, you do not get to choose which credit bureau the lender uses to obtain your credit score.

For this reason, it is essential that your rent payments are reported to as many agencies as possible.

By adding positive payment history to your credit file, you will build credit and improve your credit score.

In a recent study, we found that *48% of paying, credit repair clients got a 100+ credit score gain or more. If you don't have serious time to devote to your dispute letters, we recommend you hire the pros to help. Check out our #1 choice for professional credit repair.

How To Choose A Rent Reporting Service?

Not all rent reporting services are created equal...

In fact, many of them only offer to report to one of the three major credit agencies.

This means that your credit score will improve only at that one credit bureau because agencies DO NOT share information collected with one another.

Quick Tip:

The truth is, it is a waste of your money to pay a rent reporting service to only report to one credit agency.

The only way to maximize your rent reporting is by choosing a service that reports to more than one credit bureau.

RentTrack, aka CreditPop, is the only reporting service to report to all three of the major credit agencies.

However, unlike the other Reporting services, they require you to make your rental or lease payment through their company, who then writes a check to your Landlord.

Raise Your Credit Score For Free!

Experian Boost credits you for paying utility and cell phone bills which improves your credit score for free.

It's quick, easy, and free.

Even if they offered to wire the money using a USAA routing number, I'm still not sure RentTrack's system is very practical.

If you are anything like me, that is a significant problem because I pay my rent the last day I can, without it being late.

Credit Agencies The Rent Reporting Services Report To

TransUnion | Equifax | Experian | |

|---|---|---|---|

RentTrack | YES | YES | YES |

RentReporters | YES | YES | NO |

Rock the Score | YES | YES | NO |

Rental Kharma | YES | NO | NO |

*Credit Rent Boost | YES | *NO | NO |

Rent Report Team | YES | NO | NO |

To use the RentTrack aka Credit Pop service, you would need to pay your rent seven days early to be sure that the payment made it to your Landlord in time to not be late.

For this reason, I do not feel like Rent Track, aka CreditPop is a good rent reporting service to choose for most people.

However, RentReporters and Rock the Score report to TransUnion and Equifax and our are top recommended picks.

Low Credit Score?

Get a free consultation with a credit repair expert to see how much they can help your credit score.

It's quick, easy, and free.

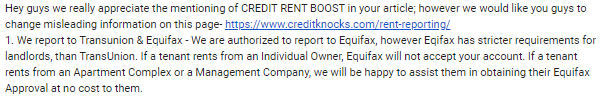

* Credit Rent Boost contacted us and said that they do report to Equifax but they have stricter reporting standards. If you are renting from an individual they will not be able to report to Equifax. If the tenant is renting from an apartment complex or management company they can report to Equifax.

Here's the problem with this email and claim...

I rent from a large apartment complex with multiple properties across Southern California.

I hired Credit Rent Boost to report my back rental payments and monthly payments to the credit bureaus.

Guess what... they only reported to TransUnion.

Buyer beware!!!!

This is the email sent to us from Mario at Credit Rent Boost.

Rent Reporting Services

Business since: 2012

BBB rating: A-

Bureaus reporting to: Equifax/TransUnion

Rent Reporters Price & Cost

Individual monthly: $9.95

Startup cost per credit bureau: $47.48*

*Best price compared to the rest on list

RentReporters

Based on initial startup costs, including 24 months of back reporting, Rent Reporters tops the list for the best priced Rent Reporting service. Their customers also will receive a free credit score.

How much will my credit score increase?

"For thousands of Rent Reporters’ customers, the average increase they see in as little as 15 days is 35-50 points."

Read Full RentReporters Reviews

Experian Boost Is Free!

Experian Boost credits you for paying utility and cell phone bills which improves your credit score for free.

It's quick, easy, and free.

Business since: 2011

BBB rating: F

Bureaus reporting to: TransUnion

Rental Kharma Price & Cost

Individual monthly: $6.95

Startup cost per credit bureau: $50.00

Rental Kharma

Rental Kharma appears to be well priced. However, they only report to one credit agency out of the three. This means that if a lender pulls credit from the other two agencies you will not get credit for you rental payments.

How much will my credit score increase?

"On average for a two year verification it's 40 points. For ongoing ONLY it's 29 points for 2-4 months of reporting."

Business since: 2017

BBB rating: N/A

Bureaus reporting to: Equifax/TransUnion

Rock the Score Price & Cost

Individual monthly: $8.95

Startup cost per credit bureau: $62.00

Rock the Score

Rock the Score provides a lot of credit building resources including a section of tips and credit education. In addition Rock the Score offers a secured credit cards to its customers. Interested in a secured credit card, checkout OpenSky Visa!

How much will my credit score increase?

"This really depends on the client’s credit profile. We have had someone go from a “no score” to 708 in just 30 days, we have seen 60, 70, 80 points increases for client’s with a thin credit profile Someone with a more robust credit profile the increase will be much less (10-15) points. Our average is 37 points."

Low Credit Score?

Get a free consultation with a credit repair expert to see how much they can help your credit score.

It's quick, easy, and free.

Business since: 2016

BBB rating: A

Bureaus reporting to: **TransUnion

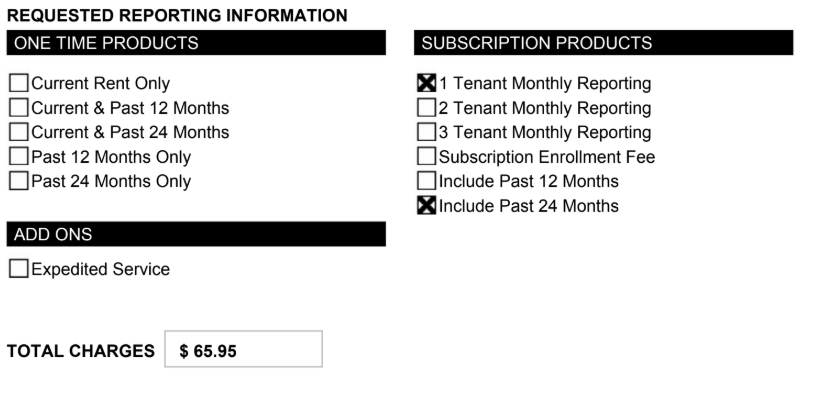

Credit Rent Boost Price & Cost

Individual monthly: $5.95

Startup cost per credit bureau: $65.95

Credit Rent Boost

** Equifax supposedly is only reported to if you live in a large apartment complex or have a large property manager which I have but, when I personally signed up, they only reported to TransUnion...

How much will my credit score increase?

"Credit score claims - No two credit profiles are identical. However, we have generally seen a range of 7 to 120 point increases."

Business since: 2014

BBB rating: D

Bureaus reporting to: Equifax/TransUnion/Experian

Rent Track/CreditPop Price & Cost

Individual monthly: $9.95

Startup cost per credit bureau: $82.92

RentTrack now is CreditPop

RentTrack is moving their rent reporting customers and new customers to their new business, CreditPop. The CreditPop business model will be very similar to other Rent Reporting services on this list and no longer require rental payments through RentTrack.

How much will my credit score increase?

"Not all credit scores (including FICO scores before FICO '09) consider rental information and therefore may not factor in rent payments appropriately. In addition, there can be many changes month over month in all the factors that make up your credit score (read more about What Impacts Your Credit), so it is difficult to predict how one factor might impact it alone."

Business since: 2017

BBB rating: N/A

Bureaus reporting to: TransUnion

Rent Report Team Price & Cost

Individual monthly: $8.99

Startup cost per credit bureau: $149.99

Rent Report Team

Rent Report Team is a relatively newcomer to the Rent Reporting services. They offer reporting to TransUnion and also give you access to a VantageScore 3.0 TransUnion credit score that is updated on a monthly basis.

How much will my credit score increase?

"Within 15 days your credit score can increase 25-50 points."

Raise Your Credit Score For Free!

Experian Boost credits you for paying utility and cell phone bills which improves your credit score for free.

It's quick, easy, and free.

Price To Report Per Credit Bureau

Don't be fooled by the deceptive rent report pricing going on with some of the single credit bureau reporters.

When you are comparing apples to oranges, the best way to attract customers is by touting the 'lowest' prices.

Quick Note:

To accurately compare rent reporting pricing you must know the number of credit agencies that they will report your rental payments to.

However, when it comes to most things in life, you usually get what you pay for, and rent reporting is no different.

While many of the companies offer competitive pricing upon closer examination, most are not that competitive considering what you are getting in return.

Companies like Rental Kharma appear to offer a really affordable initial startup price that includes the reporting 24 months of your previous rent.

Wanna Know the Easy Way to Repair Your Credit?

In a recent study, we found that *48% of paying, credit repair clients got a 100+ credit score gain or more. Get help from the pros! Check out our #1 choice for professional credit repair.

But, upon closer review, you will find they only offer to report to one credit bureau, TransUnion, while a few of their competitors provide reporting to two bureaus for only a few dollars more.

To accurately compare rent reporting services to one another, you need to take a look at how much they cost initially to start the service and divide it by the number of credit agencies they will report to.

This number will give you an accurate price to compare to each service and make sure you are getting the best deal by comparing apples to apples.

Rent Reporting Services | *Startup & 24 Mo. Back | **Single Mo. Report Fee |

|---|---|---|

RentReporters | $47.48 | $9.95 |

Rental Kharma | $50.00 | $6.95 |

Rock the Score | $62.00 | $8.95 |

***Credit Rent Boost | $65.95 | $5.95 |

RentTrack | $82.92 | $9.95 |

Rent Report Team | $149.99 | $8.99 |

* Total initial startup fees and cost to report 24 months of back rental payments divided by the number of credit agencies reported the service reports to.

** The monthly cost charged starting the second month to have your monthly rental payment reported.

*** Credit Rent Boost claims to also report to Equifax if you rent from an apartment complex or property manager. If this is true, they would be the least expensive to choose. However, I rent from a large apartment complex and paid Credit Rent Boost $65.95 and they only reported to TransUnion. Buyer beware...

My receipt from Credit Rent Boost... Paid in Full.

How Much Will My Credit Score Increase?

As with most credit building tools, people with a thin credit file or limited to no credit will see the most significant credit score increase because they have no credit history.

People with thin credit files (no credit or limited credit) report seeing their credit score increase by hundreds of points.

I enrolled for rent reporting with Credit Rent Boost in March and saw about a 15 point credit increase at TransUnion when they reported my previous 24 months of rental payments.

This is because I have a thick credit file, full of good and bad credit history.

If you have bad credit with a lot of credit history, rent reporting will be good for the long term credit building game, but you won't see as big of a boost as someone with a thin credit file.

Be Careful!

People with thin credit files aka, no, limited, or new to credit, will see the largest credit score gains. If you have bad credit with a thick file don't expect much more than a 25 point gain from the 24 months of back reporting.

Most of the credit reporting services track their customer's credit score gains, and we have provided you with their claims in each of the companies highlights above.

Experian Boost Is Free!

Experian Boost credits you for paying utility and cell phone bills which improves your credit score for free.

It's quick, easy, and free.

Landlord Enrolled Reporting Services

There are a few other rent reporting services you may find on the internet that may cost you less money.

However, these services are not available to you unless your Landlord signs up for these companies to collect your rent payments on their behalf.

You can contact these Rent Reporting services and ask if your Landlord has signed up.

If not, you will need to use one of the services above.

Your Landlord or property manager must be enrolled in the program for you to be eligible to have your rental payments reported by the following companies:

Increase Your Credit by 100+ Points

In a recent study at Credit Knocks, we found that *48% of clients who used a credit repair company got a credit score increase of 100+ points.

Consultation is quick, easy, and free.

Take Action!!!

If you have bad credit or no credit than signing up for rent reporting is a great idea!

There are many services to choose from, but the best ones are the lowest cost to report to TransUnion and Equifax, such as RentReporters.

Keep in mind that someone with a thin credit file could improve their credit score well over 100 points and be in the 700's in a few weeks.

FIVE CREDIT BUILDING ARTICLES EVERYONE NEEDS TO READ TODAY

Editorial Note: The editorial content on this page is not provided or commissioned by any financial institution. Any opinions, analyses, reviews, statements or recommendations expressed in this article are those of the author’s alone, and may not have been reviewed, approved or otherwise endorsed by any of these entities prior to publication.