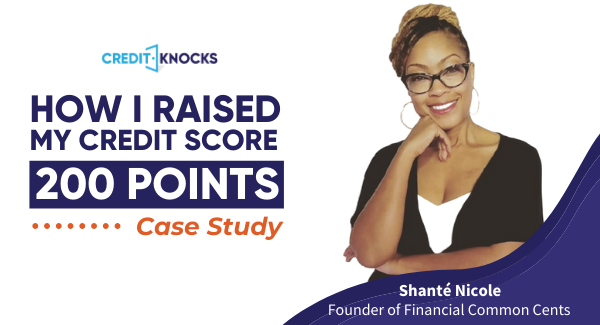

Summary: From homeless and jobless to raising my FICO credit by 200 points and founding Financial Common Cents (and a 78,000 member Facebook Community), here's how I did it!

As a financial educator and credit coach, I have helped thousands of individuals around the world become better stewards of their money by providing tips, resources, and instruction on the topics of debt management, building and repairing their credit, savings, spending habits, and budgeting.

So, what put that spark in me to want to help others on this path to excellent creditworthiness and financial freedom?

Bills and Credit and Debt, OH MY! Bills and Credit and Debt, OH MY!

Does this chant ring a bell?

Perhaps you remember the scene from “The Wizard of Oz” when the characters were skipping through the woods, trying to make it to Emerald City.

As they journeyed, they were warned that they might encounter lions, tigers, and bears along the way.

Emerald City was a magical place where wishes were granted and dreams came to life. Here, they could find the very things they'd been searching for; the things they longed for.

Increase Your Credit by 100+ Points

In a recent study at Credit Knocks, we found that *48% of clients who used a credit repair company got a credit score increase of 100+ points.

Consultation is quick, easy, and free.

My First Experience with Credit Cards

I moved out on my own at the age of 19.

Working a job that merely paid $8.25, I had to rely heavily on credit cards to help me get by.

Needless to say, debt caught up with and overtook me QUICKLY! I tried my best to stay on top of my credit card bills, but I began thinking to myself, at this rate, I should be out of debt in …NEVER!

I had always been very knowledgeable about budgeting and credit repair, and during this stage in my life I did everything in my power to apply what I knew, but sometimes life throws you curve balls.

…and they are extremely hard to hit or catch if you aren’t prepared.

Get Our 4-Week Credit Boost Free!

Step-by-step guide to improve your credit score 50-100 points in 30 days! It's free!

In 2001, a major “twister” blew through my life.

I was diagnosed with stage III Hodgkin’s Lymphoma, a form of cancer. My house was spinning out of control. Out of a window, I could see surgeries, chemotherapy, radiation therapy, follow up appointments, blood draws, and medications swirling around, putting me in an even deeper, darker financial hole.

But, if that couldn't stop me, nothing would stop me from getting back on my feet and increasing my credit score 200 points.

Medical Bills, Deductibles, and Collections, OH MY!

Sure, I had medical insurance, however, deductibles and co-payments piled up, and they piled up fast!

Bills went without payments, and a good number of my accounts were sent to collection agencies.

My scores took a hit and plunged deep, but at this point in my life, I couldn’t have cared less about my credit score. I was fighting for my life and that was my only focus.

Once I was in remission, the winds finally subsided and my financial twister began to settle down.

A few years passed and credit card debt and bills were paid in full. I began utilizing my credit cards appropriately, collection items were paid and removed from my credit reports, and my scores increased. I was just starting to regain control of my credit and finances…and then…another twister!

Quick Note:

It's never too late to work on your credit score. Even during my struggles, when I used my credit responsibly, my score would jump back up.

In 2010, I went through a divorce.

I was left with thousands of dollars of debt and a drained 401k. Oh, and did I also mention that I lost my job?

Just when it seemed I was in control of my finances, I found myself caught up in another devastating storm. I could not find full-time employment to save my life.

I submitted applications. I went on interviews with no callbacks. This resulted in losing my apartment and becoming homeless.

HOMELESS, with a 4 year old autistic child! There was a light at the end of the tunnel, and it seemed to be a train, coming at me, in full force.

My credit score at the time was at an all-time low of 546.

In a recent study, we found that *48% of paying, credit repair clients got a 100+ credit score gain or more. If you don't have serious time to devote to credit restoration, we recommend you hire the pros to help. Check out our #1 choice for professional credit repair.

Recovering from a 546 Credit Score Started with Education

I decided to go back to school (well, hello student loans!). Instead of a full-time job, I found two part-time jobs. The struggle was real…but I survived!

I graduated in 2013 and was ready to conquer the world. Let’s lock down this job! Let’s pay off this debt! Let’s restore this credit! Let’s get a substantial savings plan in place!

Well, a year and a half later…no full-time job, no savings, MORE debt, and poor credit.

I needed help, and I needed it badly. But you know what my saving grace was…EDUCATION.

Just like when I was fighting cancer, just like when I was attempting to regain financial control after my divorce and job loss…I knew EXACTLY what I needed to do to recover. See how below...

And recover, I did! In fact, I was able to raise my FICO score by over 200 points over the next few years!

Surviving all of this prompted me to share my story with others who may feel defeated on their path to becoming financial stable and free.

I created a community of like-minded individuals on Facebook, with now over 78,000 members, all seeking to better their finances and bounce back from any hardships they have faced or are currently facing.

There, I share the information that helped me bounce back, and things they can do to accomplish their credit and financial goals. From there, it catapulted into a full time business…Financial Common Cents!

Low Credit Score?

Get a free consultation with a credit repair expert to see how much they can help your credit score.

It's quick, easy, and free.

How I Increased My FICO Score By 200 Points

At my lowest point, my credit score was 546. I had been through:

I’d like to share with you a few of the tips that helped me on my journey:

#1 - I Tracked My FICO Score and Learned How Credit Scores are Calculated

First, I learned the free credit scores you get from sites like Credit Karma are for education purposes and pretty worthless. These are known as VantageScores.

IGNORE those scores!

Don't get me wrong. I increased my VantageScore by 200 points as well. But lenders don't use the VantageScore.

The score 90% of lenders use to approve you for credit cards, auto, or home loans...is the FICO score.

I used MyFICO to keep track of my FICO credit scores.

I also learned what made up my credit score.

For example, payment history is the #1 component of credit score and credit utilization is #2. If you're shooting for a massive FICO score gain (like 200 points), you've got to nail these. (I discuss how in the next sections)

This is one of the most critical pieces of information you need to know in order to start your journey to rebuilding and repairing your credit. Knowing this can help you understand what steps you need to take to begin seeing boosts in scores.

Important:

Some sites will give you a free FICO 8 or 9 score but typically only from one credit bureau. To get your scores from all 3 credit bureaus, you can sign up for MyFICO.

#2 - I Made On-Time Payments (Plus a Hack to Speed this Up!)

Credit is really all about showing how responsible you are with borrowing money and paying it back, and not just paying it back, but paying on time.

It’s fine and dandy if you can show that you have the ability to pay what you borrowed, but the creditors not only want their money, but when they’ve asked for it.

Constant late payments, which can end up in charge off and/or collection status, can give the impression that you are an irresponsible consumer. Lenders will deem you risky and it will have a negative effect on your scores, as “Payment history” is the highest component of how scores are calculated.

Once I starting paying on time, every time, my score shot up.

Free Hack to Add 10 Years of Payment History:

Ok, so now you understand payment history is the #1 thing that affects your score. And normally, it takes time to build up a solid history of on-time payments, right?

BUT...

One way to "trick" the system is to get a family member to add you as an "authorized user" to their credit card. The benefit is your credit file will inherit that card's payment history. So if the account is 10 years old, your credit file immediately looks like you've been paying on that tradeline for 10 years! Note, you only want to do this if they have a good payment history.

Quick Tip:

Don't have a friend or family member with an established card? Or they won't add you? Tradeline Supply Company allows you to buy your way into an authorized user position on a great credit card.

Simply ask your relative or friend to call their credit card company and add you as an authorized user.

All it takes is a 2 minute phone call.

Your relative needs to call their credit card company and request they add you as an authorized user to the account. They will need your:

- Name

- Date of birth

- Social security number

It's usually free and it won't hurt your family member's credit as long as you don't charge anything on your card. Your family member can even request the card be sent to their home rather than to you!

#3 - I Mastered "Credit Utilization"

Having a good credit is about a lot more than not having negative items on your credit reports.

It is quite possible to have no negative items reporting, and still have low credit scores.

How is this possible?

Well, “Utilization” is the second highest component of a FICO score. Credit utilization is simply a measure of how much of your available credit you're using.

If you’re showing too much or not showing any, this can have a negative impact.

Get in the habit of using credit cards consistently, keeping utilization low (between 10-30%), and paying in full when the bills are due.

Also, using credit cards for money you already have ensures that you’re able to pay in full, which helps you avoid paying interest, because let’s face it…who wants to end up paying more than the original purchase price for an item?

Note: The authorized user strategy above also helps lower your credit utilization since it adds more credit limit.

#4 - I Got a Secured Credit Card (And Didn't Apply for Multiple Cards)

Start with a secured credit card and don't apply for multiple cards in a short period of time.

I know, I know…in order to have good credit, you need to have obtain credit, and in order to obtain credit, you have to apply.

HOWEVER, it is never wise to apply for multiple lines of credit, back to back. When I was in the process of rebuilding, I recognized that it was unlikely that I’d receive an unsecured credit card, so I started with a nice $300 secured card with Bank of America, which eventually became unsecured after 12 months.

Secured cards are awesome credit builders. You deposit a small amount of money to your card and that becomes your credit limit.

If you have bad credit, it may be the only card you can get approved for since there's no risk to the credit card company. But it builds your credit just like an unsecured card!

#5 - Stay Motivated: Improving Your Score Takes Time and Patience

As you ease on down the road to repairing your credit and getting out of debt (yes, I’m still sticking to “Wizard of Oz” references), you may grow tired, frustrated, and impatient.

You may reach your field of poppies (poppies were flowers in the movie, known for causing you to enter a slumber-like state). You will feel like you’ve been working at it for months, maybe even years, without seeing much progress.

When you reach this point, don’t slumber. Don’t stop. Don’t rest. Don’t get discouraged. Don’t head back to the starting point, just because the goal to the finish line seems so far away.

When you get to a field of poppies...RUN! Run as fast as you can! Find that motivation to continue on. Keep Emerald City in your view.

Increase Your Credit by 100+ Points

In a recent study at Credit Knocks, we found that *48% of clients who used a credit repair company got a credit score increase of 100+ points.

Consultation is quick, easy, and free.

Staying on the path has gotten me where I am today. I can proudly announce that I’ve increased my FICO and Vantage Score over 200 points and have zero credit card debt. Not only that, but I have a substantial amount of savings. Will I stop here? No, I will not!

Whatever your dreams and goals are, make them visible and tangible. Create a vision board, write small notes to yourself and post them around your home or your desk at work. Write them in your journal. Have a friend or family member hold you accountable.

Take a small step today. Sign up for MyFICO to track your FICO scores or get a secured credit card. Do whatever it takes to keep you propelling forward.

I am hopeful that in sharing my story, you will be able to utilize this information to equip yourself as you start or continue your journey down the path to YOUR Emerald City.

Get Our 4-Week Credit Boost Free!

Step-by-step guide to improve your credit score 50-100 points in 30 days! It's free!

By Shanté Nicole

Shanté's passion for serving others has always been at the center of her life. She is an autism mom, wife, author, financial fitness coach, kids money coach, certified credit consultant, holds a degree in nursing, and is the founder of her nonprofit organizations: F.A.C.E. (Facing Autism with Children Everywhere) and Financial Common Cents.

*Study participants who received 100+ point gains stayed with credit repair company for 6 months or more, on average.