WebBank Review: Credit Cards, Personal Loans, & Business Loans For 2020

Advertiser Disclaimer - Some links on this page may pay us advertising fees.

By Mark B. Huntley, J.D.

Last Updated 03/16/2020

WebBank is a nationally chartered niche financial provider for strategic partners who offer; business loans, personal loans, credit cards, and various alternative loans. Together with internationally recognized companies, such as Paypal, Dell, Yamaha, and Fingerhut; WebBank provides their customers with the financing and loans they need to purchase products on credit.

Increase Your Credit by 100+ Points

In a recent study at Credit Knocks, we found that *48% of clients who used a credit repair company got a credit score increase of 100+ points.

Consultation is quick, easy, and free.

Approval Speed

Seconds...

RATES

Rates will vary based on credit score.

EASE OF USE

Application consists of your standard information.

SUPPORT

Confusion between partners and WebBank.

Credit Knocks Overall Star Rating:

SUMMARY:

WebBank provides loans for their Brand Partners customers to purchase products on credit.

For instance, the business loan that PayPal offers their customers is actually a loan from WebBank, not PayPal.

WebBank partners with companies to provide credit to their customers, such as, Fingerhut, Yamaha, and Dell Computers.

In addition, WebBank also offers very competitive rates for direct savings and certificate of deposit accounts.

Together with their Brand Partners they offer, Business Loans, Personal Loans, Store Credit Loans, and various alternative loan products.

I've written this WebBank Review so that you can better understand 'What is WebBank?' or 'Who is WebBank?' and what they have to offer.

Who Is WebBank?

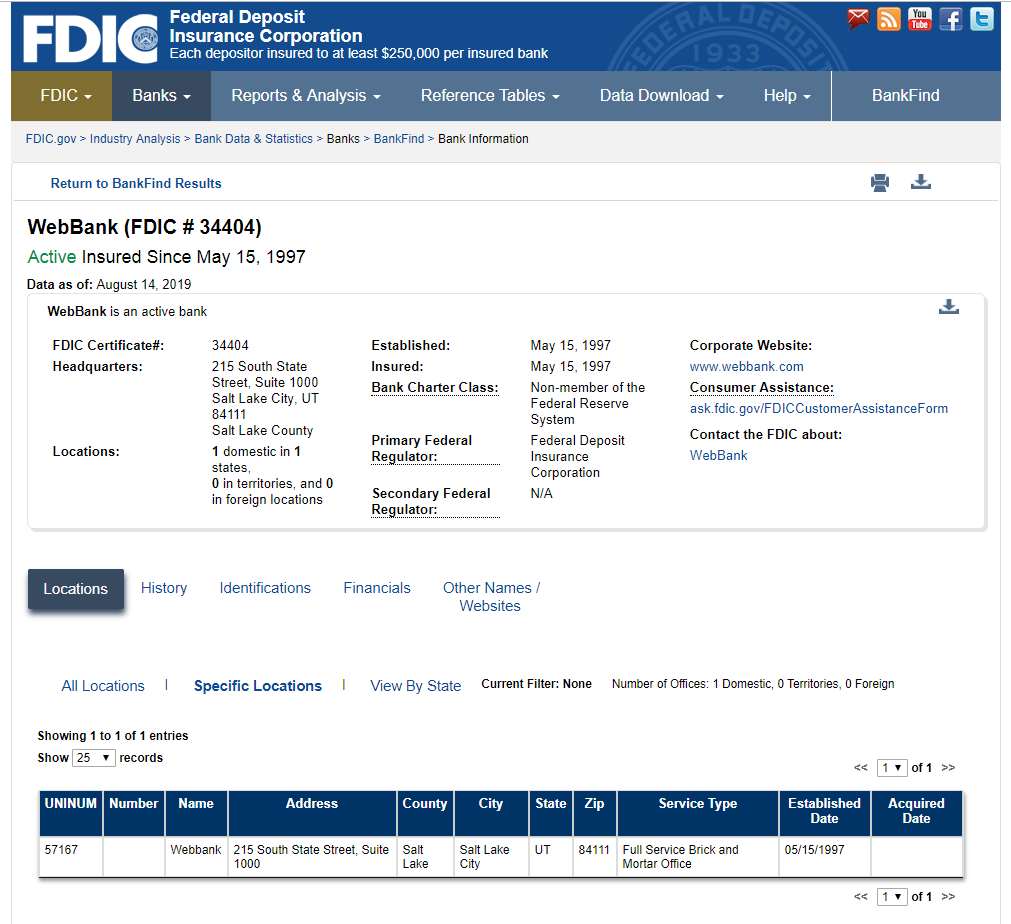

WebBank was founded in the State of Utah in 1997 under an industrial state bank charter.

They are FDIC insured, which means they must comply with federal banking laws, and your deposits are Federally insured up to $250,000.

WebBank Corporate Financial, (official long name KW) not to be confused with Webank China, has an A+ rating with the Better Business Bureau (BBB).

The BBB accredited WebBank in 2013, which requires the company to follow more stringent business ethical standards.

They are actively involved in many professional organizations, including:

- Commercial Finance Association (CFA)

- Economic Development Corporation of Utah

- Utah Association of CPAs

- Utah Association of Financial Services (UAFS)

- Utah Bankers Association (UBA)

- American Bankers Association (ABA)

- Utah Community Reinvestment Corporation

- Habitat for Humanity

- NeighborWorks Salt Lake

- University of Utah/Opportunity Scholars Program

- Junior Achievement of Utah

- National Association of Industrial Banks (NAIB)

- Salt Lake Valley Habitat for Humanity

In 2011, WebBank’s board of directors promoted Kelly Barnett to President after serving as their Chief Financial Officer (CFO) for six years.

‘Mr. Barnett has extensive experience in management, financial analysis, regulatory compliance, credit card processing and operations, budgeting, and management reporting.’ According to the WebBank leadership team section on their website.

Low Credit Score?

Get a free consultation with a credit repair expert to see how much they can help your credit score.

It's quick, easy, and free.

What Is WebBank?

WebBank offers a slew of alternative and more traditional loans through their branded partners.

While many of the WebBank loans underlying the products are traditional revolving or installment types, the products and the way they are offered are more alternative and for niche markets.

Also, WebBank credit requirements are much lower than most lenders, making them a top choice for people with no credit, limited credit, or bad credit.

Here is a list of some of the WebBank loans offered with their branded partners:

Top Branding Partnerships

Avant Credit Card & Personal Loan

WebBank partners with Avant to provide two financial products to their customers.

The first product offered is the Avant WebBank personal loan with no prepayment penalties to be used for major purchases, paying off unexpected debt, or debt consolidation.

The second product offered by WebBank Avant is the AvantCard, which is a traditional credit card that does not affect your credit score when you apply.

Can Capital

Can Capital provides working capital loans to small businesses with WebBank as the loan financier.

Can Capital have an A+ BBB rating with over 20+ years of experience, 7 billion dollars in funds lent, and 81,000 business served.

You can borrow between $2,500 and $250,000 with funds being able to be deposited by the next business day.

Increase Your Credit by 100+ Points

In a recent study at Credit Knocks, we found that *48% of clients who used a credit repair company got a credit score increase of 100+ points.

Consultation is quick, easy, and free.

Dell Financial Services

WebBank Dell Financial Services provides consumers with integrated computing technology and services.

By partnering together, they can offer their consumers a Dell Preferred Account Credit Card with no annual fees.

In addition, they have partnered to offer the WebBank Dell Business Card for small to medium businesses.

When applying for a Dell Preferred Account you may see one of the following entries appear on your credit report, ‘DFS/WebBank,’ ‘WebBank/DFS,’ ‘DFS WebBank’, or ‘WebBank DFS.’

The ‘DFS’ stands for ‘Dell Financial Services’ and should only be alarming IF YOU DID NOT APPLY for a WebBank DFS credit card.

DigniFi Formerly CFS Financial

DigniFi, formerly known as CFS Financial, offers its consumers auto repair loans with the help of WebBank.

Customers can choose from a flexible installment WebBank loan between $500 and $7,500 that are interest-free if paid off in the first 60 days.

If you don’t have the money to repair your automobile, DigniFi can get you back on the road fast.

In a recent study, we found that *48% of paying, credit repair clients got a 100+ credit score gain or more. If you don't have serious time to devote to your dispute letters, we recommend you hire the pros to help. Check out our #1 choice for professional credit repair.

WebBank Fingerhut Credit Account

Fingerhut WebBank merchants provide the Fingerhut Advantage Credit Account and the Fingerhut FreshStart installment loan.

These products are usually issued to people with no credit, limited credit, or bad credit and can be used to finance purchases from Fingerhut’s online catalog.

The WebBank Fingerhut advantage credit account issued by WebBank is a revolving loan which allows their customers to access their credit for online Fingerhut catalog purchases.

Because of the relationship between WebBank Fingerhut, they can offer credit to many people who usually would not qualify.

People with bad credit or lower credit scores (below 550) can usually qualify for the Fingerhut WebBank Fresh Start Installment Loan.

This program is extremely inexpensive with a total of six months of payments for under $5.00 a month offered through the Fingerhut/WebBank partnership.

At the end of the WebBank/FreshStart program, the customer will then be eligible for a Fingerhut credit account issued by WebBank.

Having credit with Fingerhut is like having a WebBank Fingerhut credit card without the physical card.

You can contact WebBank Fingerhut customer service to learn more about both of these programs or click on the ‘Learn More’ button below.

Gettington Credit Account Issued By WebBank

The Gettington credit account issued by WebBank offers its consumers the opportunity to purchase a wide range of items from its online store catalog.

WebBank/Gettington makes this possible by financing the WebBank Gettington Credit Account for catalog purchases.

You will see your account show up on your credit report as either ‘WebBank GTN’ or ‘WebBank/GTN.’

This is the standard way credit furnishers provide information to credit agencies.

You should only be concerned with the GTN reporting practice if you never applied for a WebBank Gettington Credit Account.

Klarna WebBank

Klarna offers an alternative shopping experience to their customers with their, ‘Shop now. Pay later.’ motto.

They have partnered with your favorite stores to bring you this unique experience.

You shop their WebBank merchants stores and use your Klarna WebBank revolving loan to pay for the merchandise which is then conveniently billed to you monthly.

Wanna Know the Easy Way to Repair Your Credit?

In a recent study, we found that *48% of paying, credit repair clients got a 100+ credit score gain or more. Get help from the pros! Check out our #1 choice for professional credit repair.

WebBank Lending Club

WebBank Lending Club has partnered to offer its customers; personal loans, small business loans, and automobile refinancing.

Lending Club WebBank auto refinance program has no origination fees or prepayment penalties.

On average, refinancing your car can save you $3,000, and you can find out if you qualify without affecting your credit score.

Mosaic Solar Loan

WebBank has partnered with Mosaic Solar to offer financing for solar energy systems, batteries, and efficient home improvements.

Solar Mosaic works with contractors to offer financing to the contractor’s clients and with homeowners to finance the purchase of clean energy and environmentally sound home improvements.

PayPal

PayPal, one of the world’s largest transaction facilitators, offers its business customers loan options with WebBank.

Together they offer three business WebBank loan options; PayPal Working Capital Loans, PayPal Business Loans for Small Businesses, and Loan Builder loans.

They offer business loans from $5,000 to $500,000 with approval in minutes and next-day funding options.

Paypal has a great bill me later program that people sometimes refer to as ‘WebBank Bill Me Later’ or ‘WebBank BML.’

The BML credit allows you six months to pay off the loan borrowed without having to pay interest.

However, there is no WebBank Bill Me Later credit account with PayPal; Synchrony Bank issues this loan program.

Petal Card

Petal Card offers a traditional revolving loan credit card with no annual fees to its customers.

WebBank provides the financing for the Petal credit card through their Brand Partnership program.

Petal offers its consumers a unique cashback rewards program that grows with the number of on-time payments you make.

Increase Your Credit by 100+ Points

In a recent study at Credit Knocks, we found that *48% of clients who used a credit repair company got a credit score increase of 100+ points.

Consultation is quick, easy, and free.

Prosper WebBank

Prosper WebBank offers consumers the option of a fixed rate or unsecured personal loan through WebBank.

They recently started offering home equity lines of credit (HELOC) loans in a limited number of states at myprospercash.com.

Proper/WebBank loans offer the ability to pay them back early without a prepayment penalty.

Upgrade Personal Loans

WebBank and Upgrade offer fixed-rate, unsecured installment loans for debt consolidation, home improvements, and many other occasions.

Upgrade WebBank personal loans are available for $1,000 to $50,000 with payment terms between 36 months and 60 months.

Yamaha Motor Finance Corporation

Yamaha Motor Corporation has been producing world-class motors and Motorsport products for decades.

They have partnered with WebBank to provide their consumers with a Yamaha open-ended revolving credit card for the purchase of their products nationwide.

The WebBank Yamaha card application is straight forward, and a decision is made almost instantly.

Low Credit Score?

Get a free consultation with a credit repair expert to see how much they can help your credit score.

It's quick, easy, and free.

Zerocard MasterCard

Zero offers the Zerocard MasterCard Credit Card with WebBank as the issuer.

The Zerocard can be used at any location MasterCard is accepted and does not have an annual fee.

WebBank Credit Cards Issued By Their Brand Partners

WebBank credit cards are offered through their brand partners Avant and Petal.

These credit cards issued by WebBank MasterCard and Visa to Avant and Petal customers with the bank underwriting the loan and deciding on credit approval.

WebBank cards are issued with their branding partners name and custom design.

The WebBank credit card list includes:

AvantCard MasterCard

Petal Cashback Visa Card

Web also offers four revolving loan credit accounts that can only be used to purchase products from each stores product catalog.

In most instances, there aren’t physical cards issued by WebBank for credit accounts.

The four-credit accounts that WebBank presently offers financing for, are:

Fingerhut Credit Account

Gettington Credit Account

Dell Preferred Account Credit

Yamaha Credit Account

Be sure to check out one of the WebBank merchants whether you are looking for WebBank credit card offers or a credit account.

In a recent study, we found that *48% of paying, credit repair clients got a 100+ credit score gain or more. If you don't have serious time to devote to your dispute letters, we recommend you hire the pros to help. Our #1 choice for professional credit repair.

What Happened To The WebBank Pearl Card Gold MasterCard?

If you are trying to apply for WebBank Pearl Card Gold MasterCard, you are out of luck.

In the 2000’s Genesis Financial Solutions, Inc. (GFS) and NCO Portfolio Management Inc. approached WebBank about issuing a credit card.

They agreed on issuing the WebBank Pearl credit card, and they commenced attracting customers.

At some point in 2010, Genesis Financial Solutions, Inc. (GFS) and NCO Portfolio Management, Inc. began attempting to collect debts by using fake pre-approved WebBank Pearl Gold MasterCard letters.

A class-action lawsuit for consumer fraud was filed against GFS Financial Solutions and NCO Portfolio Management along with WebBank.

At no time was it ever alleged that WebBank knew of any of GFS and NCO’s actions.

WebBank promptly discontinued the Pearl Gold MasterCard and their partnership with the two bad actors.

It is assumed that the parties settled the lawsuit with a non-disclosure agreement as there have been no further reports on the matter.

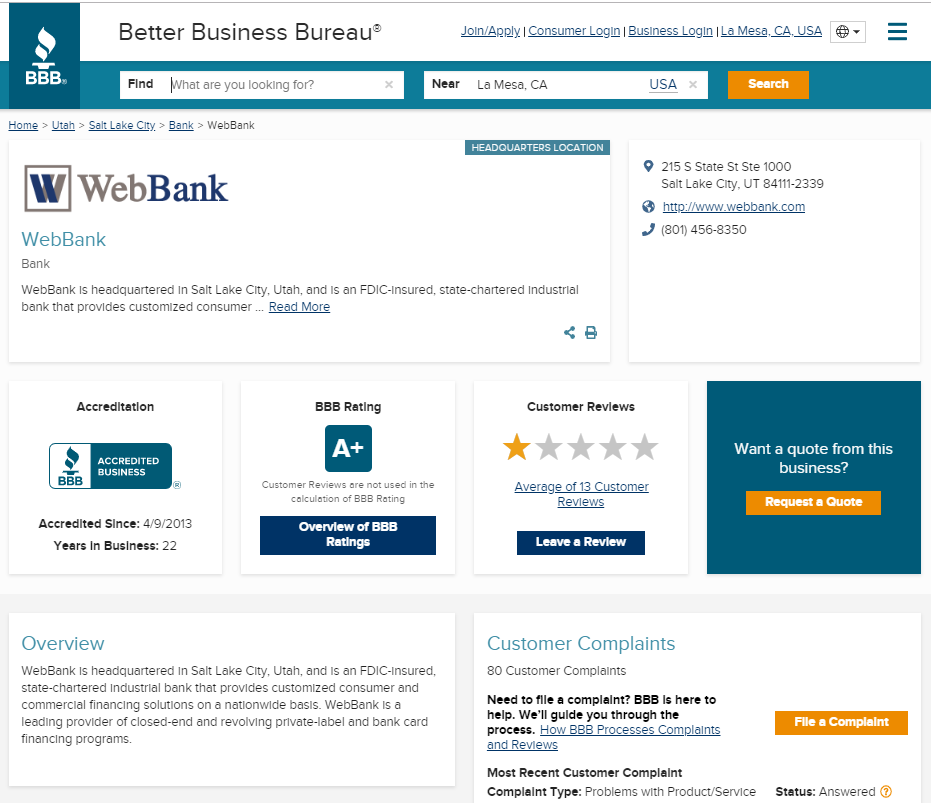

WebBank Reviews

WebBank issues many different types of loans for a large number of Brand Partners.

Many people appear to be confused with who they need to speak to when there is a problem with their loan.

There are over 80 complaints against WebBank on their BBB website, but almost everyone one of them should have been directed towards their brand partners.

There are also many favorable WebBank reviews for companies such as Fingerhut and PayPal that should probably be attributed to the brand partner and not the bank.

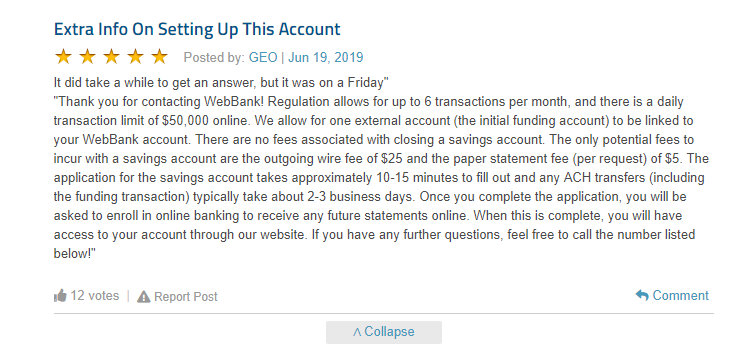

However, many people forget that they do directly work with customers and offer savings accounts and certificates of deposits at competitive rates.

WebBank reviews for these services tend to generally be very positive and favorable for their customer service and high-interest rates offered.

Image and Reviews from Deposit Accounts

Editorial Note: The editorial content on this page is not provided or commissioned by any financial institution. Any opinions, analyses, reviews, statements or recommendations expressed in this article are those of the author’s alone, and may not have been reviewed, approved or otherwise endorsed by any of these entities prior to publication.